Tokenization Overview

What is Payment Tokenization?

Tokenization is an extra security measure that takes place when consumers make a payment online or in a physical store, to protect their confidential information such as credit/debit card number (PAN). Tokenization replaces a traditional card account number with a unique payment digital identifier, and it restricts the use of a payment token by device, merchant, transaction type or channel with new data, referred to as tokens. These tokens are associated with the credit/debit card of a specific consumer.

The main benefit of payment tokenization is that it protects consumer card data by decreasing exposure.

Who are the Key Players in the Tokenization Ecosystem?

- Issuer & processor – issues the credit/debit card from which the token is derived and approves requests to provision tokens for the cards through integration.

- Novopayment: enables the exchange of data between cardholder and partners Visa/Mastercard.

- Cardholder: owner of credit/debit card, they enter card data to set up digital wallet on their mobile device.

- Visa or Mastercard: Depending on the card used, the network creates, stores, and validates tokens.

- Digital wallet provider: requests and stores tokens for the respective credit/debit cards. Each wallet undergoes a validation process for networks to authorize the token request.

Which users prefer the I-TSP model?

- Issuer Programs

- Merchant Programs

How it Works

Tokenization for Issuers

NovoPayment as Token Service Provider, offers a set of endpoints that allow issuers to provision tokens, life cycle for the following types of tokens:

- Contactless mobile payments (Proximity) NFC, using host card emulation (HCE), allowing users to se their devices (smartphones) to make payments

- E-commerce wallet providers

- Card-on-file(COF) Visa cards for merchant participants

Tokenization for Digital Wallets

NovoPayment as Token Service Provider of a Digital Wallet, offers a set of endpoints or libraries (APIs/SDK) that enables the request for tokens associated with Visa an Mastercard franchises. This solution facilitates the provisioning and management of the token life cycle, in payment applicatuions and mobile devices.

Tokenization for eCommerce (CoF)

NovoPayment as Token Service Provider for CoF in eCommerce offers a set endpoints (APIs) that enables the request of tokens associated with Visa and Mastercard franchises. This solutio faciltates the provisioning and management of the token life cycle, in payment applications.

Frequently Asked Questions (FAQ)

How long do tokens last?

- Tokens can be temporary or permanent, it is up to the bank to determine.

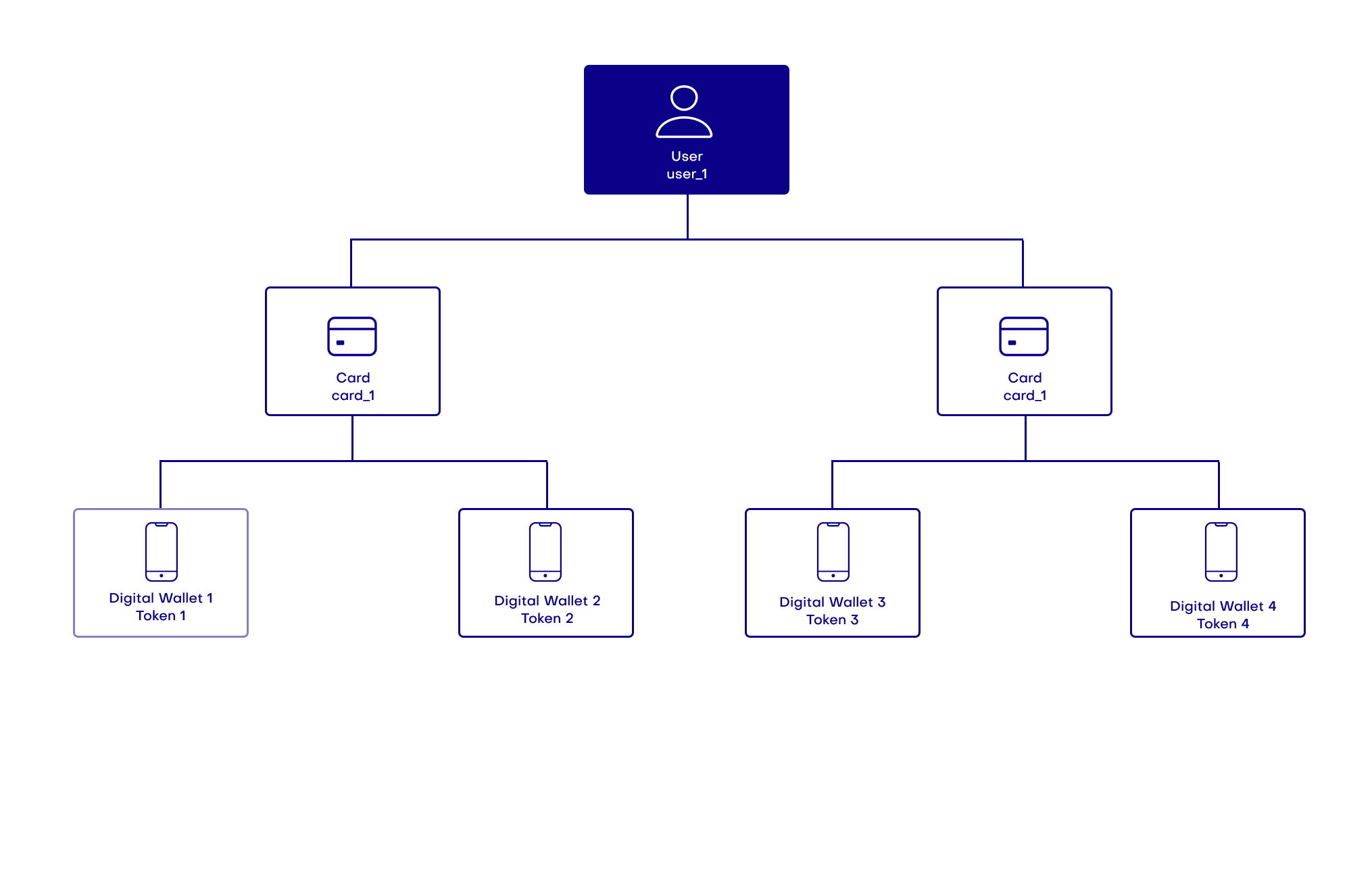

What if a customer has 2 cards in their digital wallet? How does it work?

- Each card is assigned a single unique token per card per digital wallet. If there are 2 or more cards in the wallet, each gets one token. If the same card is used in different wallets, they get different tokens.

- Every user can have multiple active cards in their distinct digital wallets. Each of the cards gets assigned a different token. If the same card is used for two digital wallets, they will be associated with two different tokens.