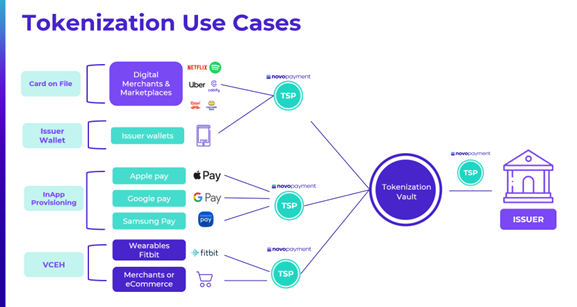

Tokenization involves the replacement of sensitive account information, such as the 16-digit account number with a unique identifier called a token. This allows payments to be processed without exposing account details that can potentially be compromised.

Using tokenization in your business has shown to reduces the fraud rates by 28%, enabling more secure transactions more secure for your customers, in addition to a 3% increase in approval rates.

NovoPayment offers a range of APIs and services that provide secure and efficient payment processing solutions, for all sizes of businesses. Whether you're building a mobile app, an e-commerce website, or a point-of-sale system, NovoPayment's APIs can help you to securely process payments and protect your customers' sensitive information.

-

Issuer Tokenization API:

With NovoPayment's Tokenization API for Issuers, you can manage and authorize the tokenization process, replacing sensitive payment and user information for a token and storing it securely on our servers. This helps to significatly reduce the risk of fraud and data breaches, as the actual payment information is not stored on your own servers.

This APIs provides a simple and secure way to handle sensitive payment information, making it a valuable tool for any business that wants to process payments online.

The basic package of this service includes APIs for authorization processing and other groups to manage the tokens.

Additionally, the Issuer can implement a series of APIs to allow the card credentials to be sent directly from an Issuer's wallet to a third-party wallet, such as ApplePay® , GooglePay®, and SamsungPay®. This set of services is called Push Provisioning.

Push provisioning can also be enabled for other wallets such as Garming Pay, Fitbit Pay* and a service known as “Click to Pay”.